Bad Cibil Loan App List For You in 2024: 25+ Bad Cibil Loan Apps. A low CIBIL score can make it difficult for you to obtain credit, such as loans or credit cards, and if you do, it could result in higher interest rates or unfavourable terms. Additionally, it could make it difficult for you to find a job, rent an apartment, or even get affordable insurance.

Responsible financial management is typically required to raise a low CIBIL score, including timely payments, debt repayment, and a reduction in credit requests. Your CIBIL score may steadily rise as you exhibit better credit behaviour over time. To keep track of your progress and rectify any inaccuracies or anomalies that might be harming your score, it’s critical to routinely check your credit report and score.

25+ Bad Cibil Score Loan Apps List 2024: Bad Cibil Loan App List

| App Name | Interest Rate |

| mPokket | 0% To 4% p.m. |

| LazyPay | 16% To 32% p.a. |

| Money View | 16% To 39% p.a. |

| Bajaj Finserv | 12% To 34% p.a. |

| Home Credit | 18% To 56% p.a. |

| SmartCoin | Upto 30% |

| CASHe | Upto 30.42% |

| NIRA | 24% To 36% |

| KreditBee | Upto 29.95% |

| PaySense | 16% To 36% p.a. |

| MoneyTap | 13% p.a. |

| PayMeIndia | 18% To 36% p.a. |

| Dhani | Upto 42% p.a. |

| Early Salary | 15% To 40% p.a. |

| India Lends | 10.25% To 25% p.a. |

| Paytm Pay Later | 10.5% To 485 p.a. |

| Zest Money | 3% To 36% p.a. |

| DigiMoney | 19% To 34% p.a. |

| IndusMobile: Digital Banking | 18% To 39% p.a. |

| Mystro Loans & Neo Banking App | 15% To 36% p.a. |

| Kissht | 18% p.a. onwards |

| Prefr | 18% To 36% p.a. |

| Fair Money | 12% To 36% p.a. |

| Pay With Ring | 14% To 28% p.a. |

| Bueno Loans | 20% To 52% p.a. |

| Pocketly | 14% To 39% p.a. |

| Bajaj Markets | 14% To 52% p.a. |

| Indialends | 10.25% To 25% p.a. |

What is the Bad Cibil Score?

A bad CIBIL score, often referred to as a low or poor CIBIL score, is a credit score that falls significantly below the desired range. In India, the Credit Information Bureau (India) Limited, or CIBIL, is one of the major credit bureaus that assesses and maintains credit scores for individuals and businesses. A CIBIL score is a three-digit number that typically ranges from 300 to 900, with higher scores indicating better creditworthiness.

- 7 Days Loan App List 2024: Real Or Fake 7 Days Loan Apps List.

Here’s a general breakdown of CIBIL score ranges:

- Excellent: 750 and above

- Good: 700 – 749

- Fair: 650 – 699

- Poor: 550 – 649

- Bad: Below 550

A bad CIBIL score, which falls below 550, indicates a poor credit history and may result from various factors, including:

- Loan or credit card payments that are late or missing.

- Failing to make credit card or loan payments on time.

- High credit usage, or making heavy use of your credit line.

- Multiple credit card or loan applications are submitted quickly (which points to financial trouble).

- has a track record of paying off debts for less than the entire amount due.

- instances of accounts being written off as bad debt or sent to collections.

Eligibility Criteria For Bad Cibil Loan Apps:

Following are the minimum Eligibility Criteria For Bad Cibil Loan Apps In India. To get a Loan From these apps You need to fulfill minimum Eligibility. Check All the Required Information given below.

- You must be an Indian citizen

- You must be above the age of 21

- Your Income proof

- Minimum monthly salary of Rs.15,000 – Ra.18,000 (based on Metro or non-Metro cities)

How To Apply For Personal Loans On the Bad Cibil Loan Apps?

You can Follow This Process To get an Instant Loan From these Loan Apps If You Have a Bad credit score.

- First You need to Visit Google Playstore

- Now Search Loan App Name

- Now Download the mobile application of the lender, directly from the Google Play Store or App Store.

- Next, Register for a new user.

- After the process, you will provide the information such as name, address, ID proof, Mobile Number and email.

- Once This Whole Process is completed, upload your KYC paperwork for the personal loan agreement.

- Now enter your bank details to get a personal loan.

- Now fill out an application form.

- Once Your Loan Application is approved then Money Will be Sent to Your Account Directly.

What Problems You can Face If You Have a Bad Cibil Score?

A poor credit score, commonly referred to as a bad CIBIL score, can have serious financial repercussions. One of the key credit agencies in India that evaluates and stores credit information for people is called CIBIL, or the Credit Information Bureau (India) Limited. Here are some critical details of having a low CIBIL score:

- Financial Obstacles: A low CIBIL score can create several financial obstacles

- Higher Interest Rates

- Limited Credit Options

- Difficulty in Renting a Home

- Employment Concerns

- Impact on Insurance Premiums

- Collection Calls and Legal Action

- Longer Credit Recovery Time

- Difficulty in Financial Planning

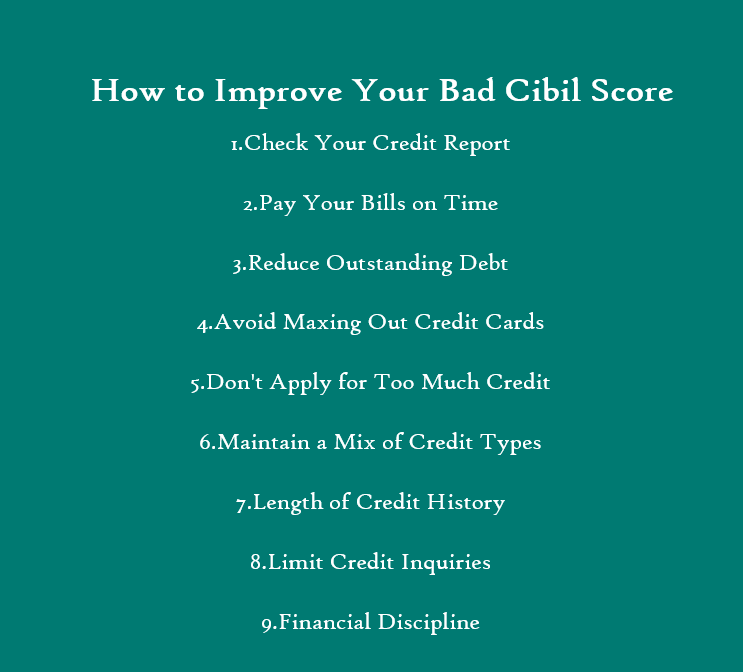

How to Improve Your Bad Cibil Score?

It takes time and effort to raise a low CIBIL score (or credit score), but with careful money management, it is doable. Lenders evaluate your creditworthiness based on your CIBIL score to decide whether to approve your credit applications. The following actions can be taken to improve a low CIBIL score:

- Check Your Credit Report

- Pay Your Bills on Time

- Reduce Outstanding Debt

- Avoid Maxing Out Credit Cards

- Don’t Apply for Too Much Credit

- Maintain a Mix of Credit Types

- Length of Credit History

- Limit Credit Inquiries

- Financial Discipline

- Seek Professional Help if Necessary:

FAQ: Bad Cibil Score Loan Apps List

I have a low CBIL score. Can I still Get a loan?

Ans: No, it can be challenging to obtain a loan if your CBIL score is low because lenders will frequently reject your application.

Can my CBIL score be raised?

Ans: You can raise your CBIL score, yes. Success is possible, but it might take some time.

Are all loan requests Risky?

Ans: No, not all loan requests involve risk. It is vital to be careful and assess credibility.

Can I apply for a loan online?

Ans: You can apply for loans online, but only if you pick a secure and reputable platform.

Can I discover my CBIL score on any website?

Ans: Yes, a lot of websites offer the Tools to check your CBIL score Online.